The closing process is often treated like a finish line, but in practice, it’s the most delicate phase of a home purchase. For a first-time home buyer, this final stretch combines emotional pressure with high financial exposure. Excitement builds, deadlines compress, and the urge to “just get it done” becomes powerful. This is exactly when irreversible mistakes tend to happen. Small oversights- an unchecked fee, a missed document clause, or an unverified repair- can ripple into years of financial or legal consequences. At this stage, buyers are no longer in broad property search mode. The focus shifts to verifying every last detail tied to the home they are about to own, and that transition can feel abrupt if it hasn’t been planned for.

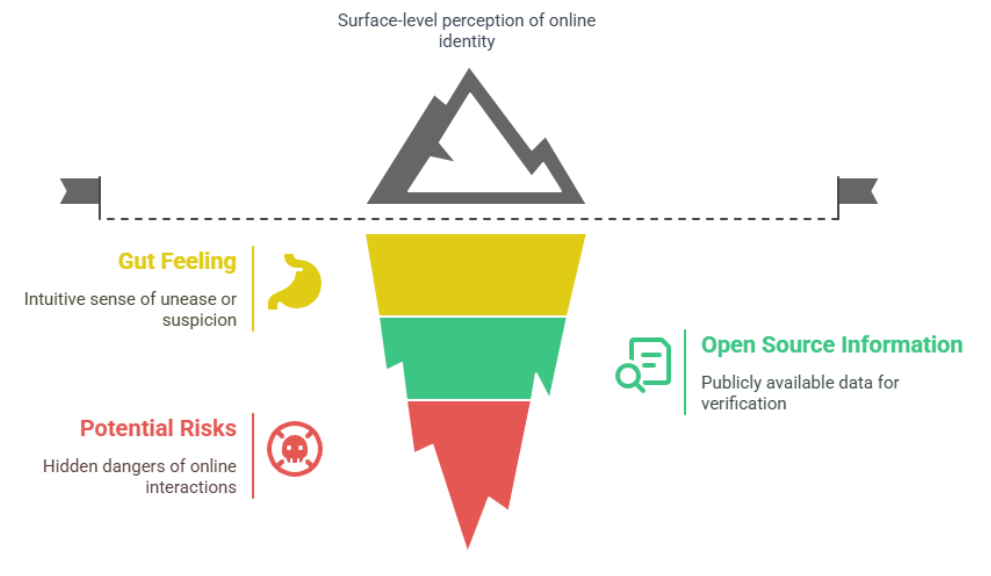

From a professional advisory standpoint, most buyer regret cases don’t start with a bad house. They start with a rushed closing process. Transaction oversight exists for a reason: to slow things down just enough to catch what stress and momentum might otherwise hide. Smart buyers use the final days to validate everything connected to the address itself, sometimes even running a reverse address lookup or a reverse address search- whether in Texas, Pennsylvania, Georgia – to confirm basic property details, past ownership signals, or potential red flags tied to the location. In more complex transactions, a reverse address finder can support last-minute verification alongside a reverse property search that helps ensure the home purchase information matches what was expected from earlier documents. Buyers who treat closing as a formal verification phase rather than a ceremonial formality consistently avoid the most expensive surprises. The home purchase itself may be emotional, but the closing process has to stay disciplined.

Timing Pressure and Information Overload

The pre-closing window compresses weeks of decision-making into a few days. Lenders release disclosures, attorneys circulate final paperwork, sellers schedule repairs, and agents push for confirmations- often all at once. For first-time buyers, this flood of information creates real estate stress that makes it harder to think critically. The volume of paperwork alone can run into the dozens of pages, each containing terms that carry long-term impact, and it can feel like the original property search was the easy part compared to this final review phase.

Professionals reduce homebuyer risk by systematizing this chaos. In real-world transactions, checklists replace memory, and workflows replace guesswork. When buyers follow a structured verification sequence- financial review first, then legal review, then property condition- they avoid the most common errors caused by multitasking. Along the way, a quick reverse address lookup can be useful for confirming address-level consistency across documents, especially when multiple parties are sending forms with slightly different formatting or abbreviations. The closing timeline doesn’t slow down for uncertainty. Only preparation gives buyers enough breathing room to catch what matters.

Reviewing the Closing Disclosure Line by Line

The closing disclosure is not a summary- it’s a legal invoice. Every lender fee, title charge, prepaid tax, and credit must match what was originally agreed. Professional advisors treat this document like an audit, comparing it directly to the loan estimate line by line. Differences should always have a written explanation, not a verbal promise to “fix it later.” Even small inconsistencies can matter, and some buyers use a reverse property search to cross-check basic property data against what appears in the paperwork, just to ensure nothing has drifted during the process.

Red flags appear in familiar places: unexplained lender fees, incorrect escrow deposits, duplicate insurance charges, or missing seller credits. Cash to close should never rise unexpectedly without documentation. In disciplined workflows, no buyer authorizes closing until every variance is reconciled in writing. It’s slow, slightly tedious work- but it consistently prevents thousands in avoidable overpayment.

Reconfirming Loan Terms and Interest Rates

Loan approval is not the finish line. Mortgage terms must be re-verified right before closing. APR, monthly payment, loan program type, and rate lock status should all match the buyer’s signed commitment. Professionals treat interest rate lock confirmations as mission-critical. An expired lock or misapplied discount point can quietly change the entire cost structure of the loan. This is also where buyers often benefit from doing one last reverse address search or using a reverse address finder to confirm that the address in the lender’s system matches the address on title and insurance paperwork, because small mismatches can create bigger administrative delays.

Verification steps typically include checking the rate lock expiration date, reconciling discount points, and confirming whether taxes or insurance are inflating the payment. Buyers who skip this step often discover errors only after funds have been wired, when corrections become legally and administratively difficult.

Legal and Contractual Safeguards

Understanding Contingencies and Buyer Rights

Contingencies are not technicalities; they are buyer protection mechanisms. Financing, inspection, and appraisal contingencies determine whether a buyer can legally delay or cancel without financial penalty. In professional case reviews, waived contingencies are one of the most common sources of irreversible losses. Buyers often underestimate how much leverage they still have before closing.

The safest approach is to reconfirm which contingencies remain active and which deadlines have passed. Written confirmation matters. In transactions where buyers waived inspection or appraisal rights too early, post-closing repair costs and value shortfalls frequently followed. Legal discipline at this stage prevents emotional decision-making from overriding financial logic.

Reviewing the Title Report and Ownership Records

Title reports reveal what the seller doesn’t always mention. Liens, easements, unpaid taxes, and boundary disputes appear here first. Professionals interpret title exceptions carefully, because not all issues are cosmetic. A utility easement may limit future renovations. An unpaid contractor lien can legally transfer to the buyer.

Standard review practice includes checking ownership history, scanning for unresolved encumbrances, and verifying that all outstanding liens will be cleared before closing. Any exception that isn’t clearly documented as “to be released” should trigger a pause. Ownership records aren’t paperwork- they’re risk maps.

Confirming Repairs and Seller Obligations

When a seller agrees to repairs, those repairs must be verified- not assumed. Documentation should include paid invoices, contractor warranties, and photographic evidence. Professionals strongly recommend reinspection whenever structural, electrical, or plumbing repairs were part of the agreement.

In advisory files, one recurring issue stands out: cosmetic fixes masking deeper problems. A patched ceiling doesn’t confirm a resolved leak. A repainted wall doesn’t prove mold remediation. Buyers who insist on repair documentation and, when appropriate, third-party reinspection consistently avoid inheriting unfinished obligations.

Conducting the Final Walkthrough

The final walkthrough is not ceremonial. It’s a functional inspection designed to confirm three things: agreed repairs are complete, the property condition hasn’t changed, and no fixtures or appliances were removed. Professional walkthrough checklists include testing outlets, running faucets, checking HVAC operation, verifying garage remotes, and confirming that no new damage exists.

Buyers should also confirm that the property is empty, clean, and free of debris unless otherwise agreed. Any discrepancy- no matter how small- should be documented before signing. The closing inspection is the buyer’s last leverage point.

Neighborhood and HOA Due Diligence

Homeowners associations create long-term financial and lifestyle obligations. Rules on rentals, renovations, parking, and pet ownership can directly affect resale value and daily comfort. Professional advisors often see buyers overlook HOA restrictions that later force expensive changes or limit income potential.

Special assessments deserve particular attention. A low monthly fee can hide a major future cost if reserves are underfunded. Buyers should request recent HOA budgets, board meeting notes, and assessment histories. This isn’t bureaucracy- it’s future financial forecasting.

Final Neighborhood Red Flag Check

Even late in the process, a final neighborhood review matters. Environmental risks, nearby construction, noise changes, or zoning approvals can surface between contract and closing. In relocation advisory work, last-minute discoveries- like a planned highway ramp or rezoning notice- have saved buyers from long-term regret.

A brief reassessment of community issues, traffic patterns, and local developments is standard professional practice. Location risk doesn’t freeze once an offer is accepted.

Insurance, Utilities, and Logistics Setup

Securing Homeowners Insurance Coverage

Lenders will not fund a loan without confirmed homeowners insurance. Coverage must meet lender requirements for dwelling value, liability, and deductible limits. Professionals treat insurance verification as a closing prerequisite, not a post-approval task.

Buyers should confirm that the policy effective date matches the closing date and that premium amounts match escrow estimates. Any mismatch can delay funding or alter the cash to close figure unexpectedly.

Scheduling Utilities and Move-In Services

Move-in logistics affect real-world livability on day one. Utility setup should include electricity, water, gas, internet, and trash service. Professionals advise scheduling transfers several days before closing to avoid service gaps.

Operational planning also includes lock changes, security system resets, and appliance warranty transfers. Buyers who coordinate these in advance avoid the quiet chaos that often follows rushed closings.

What to Bring and What to Review

Closing day requires preparation. Buyers should bring government-issued ID, certified funds confirmation (if applicable), and copies of all signed disclosures. Every document presented at closing should be reviewed- not skimmed.

Professionals advise retaining digital and physical copies of the closing disclosure, deed, title policy, and promissory note. Document retention isn’t just organizational; it’s legal protection for refinancing, resale, and tax reporting.

Costly Errors and How Professionals Prevent Them

One anonymized case involved a buyer who overlooked a $6,800 lender fee increase buried in the closing disclosure. Another waived a final walkthrough and inherited a flooded basement after a burst pipe. These mistakes weren’t caused by ignorance- they were caused by time pressure and misplaced trust.

Professional safeguards include dual verification of all numbers, mandatory walkthrough documentation, and zero-tolerance policies for undocumented changes. These systems exist because human attention fails under stress. Structure replaces luck.

Step-by-Step Verification Framework

A disciplined pre-closing checklist follows a fixed order. First: financial audit. Compare loan estimate to closing disclosure. Confirm cash to close. Verify loan terms. Second: legal audit. Reconfirm contingencies. Review title exceptions. Validate seller obligations. Third: property audit. Reinspect repairs. Conduct final walkthrough. Fourth: operational setup. Secure insurance. Schedule utilities. Prepare documents.

This framework is designed to reduce emotional bias. Each step isolates a risk category and resolves it before moving forward. Buyers who follow this structure make fewer assumptions and catch more inconsistencies.

The final step is confirmation. No closing authorization occurs until every item is marked complete. This method doesn’t slow transactions- it stabilizes them.

Final Takeaways and Expert Guidance

Closing a home purchase is not a formality- it’s a verification phase that determines long-term financial and legal stability. First-time home buyers who treat this stage with discipline consistently avoid the most painful mistakes. Every unchecked line item and every waived safeguard increases risk exposure.

Professional guidance doesn’t eliminate uncertainty, but it does replace guesswork with structure. Buyers who follow a repeatable pre-closing checklist move into ownership with clarity instead of doubt. The goal isn’t perfection. It’s confidence rooted in verified facts.